When a Payment Is Made on an Account Payable

For most businesses the accounts payable process boils down to three key steps. When payment is made against an account such that the entry in the accounts payable of a companys books is no longer outstanding it is referred to as paid on account.

Accounts Payable Process 7 Steps Of Payables Process Accountinguide

On a balance sheet Accounts Payable is shown as a Current Liability.

. Accounts payable refers to the vendor invoices against which you receive goods or services before payment is made against them. Payments made on account. In other words you are paying off a creditor.

School University of Nebraska Omaha. Accounts payable form the largest portion of the current liability section on the companys financial statements. Accounts payable is what a company owes to suppliers or vendors for received goods or services.

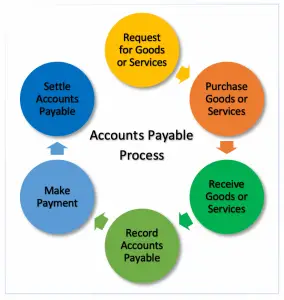

In both accounts payable AP and accounts receivable AR you will see credits and debits used when the value in your account increases or decreases. A purchase order also lists any terms and conditions for the transaction and the timelines for delivery. Accounts payable process usually starts with the request of the goods to be purchased to the purchasing department or the responsible personnel until the payment is made to the supplier of goods or services.

When you pay on account it means you are paying off an account you have with someone meaning a debt. Your credit card company represents the accounts receivable side of the transaction as they will receive payment from you. Accounts receivable is always recorded in accounting systems as an asset as it is money brought in by your business.

That is you purchase goods on credit from your suppliers. Pages 12 Ratings 100 1 1 out of 1 people found this document helpful. You are the accounts payable side of the transaction as youre responsible to pay your credit card company.

Accounts payable also known as creditors are balances of money owed to other individuals firms or companies. When a cash payment is made on an account payable a Assets and stockholders. Thus your vendors supplying goods on credit are also referred to as trade creditors.

FYI creditors are also known as accounts payable or simply payables. Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit. It represents the purchases that are unpaid by the enterprise.

What Is Accounts Payable on a Balance Sheet. The Accounts Payable or Account Payable AP is the amount of money that a business entity owes to vendorssuppliers for availing their goodsservices. The accounting for accounts payable involves the recordation and payment of liabilities.

When a cash payment is made on an account payable a. Purchase Goods or Services. Most of the invoices are debited for Expenses incurred by the company like salaries wages repair maintenance rental expenses and advertisement expenses etc.

The accounts payable process may involve seven steps including. These terms help describe the inflow and outflow of cash from your different accounts including asset accounts expense accounts and cash accounts. When recording the transaction cash is credited and accounts payable are debited.

Key steps in the AP process flow. However shareholders equity will not decrease because there is no effect on stockholders equity also payment is made t. Completing a purchase order.

On the most basic level debits indicate. Assets and stockholders equity decrease Assets and liabilities both decrease Liabilities and expenses decrease Assets and. Creditors are liabilities which increase on the right side credit and decrease on the left side debit.

Request for Goods or Services. It is referred to as current because these debts are due to be paid within a year or less. 5 Entry when the payment is made to the creditor or to payable.

A companys short-term debt or money owed to suppliers vendors and creditors is an Accounts Payable. These are short term obligations which come into existence when a sole proprietor firm or company purchases goods or services on account. 1 When payment is made to accounts payable total expense will remain the same as there will be no effect in the expense account.

When payment is made to the creditor cash is increased and accounts payable is decreased. Definition and explanation. After the creation and recording of the accounts payable liability when the payment is made to the creditor or to payable then there will be the reduction in the accounts payable liability and the same will be recorded by making a journal entry as follows.

View the full answer. Course Title Accounting 2010. This is the primary functional area through which a business records expenses and pays other parties.

Accounts payable is credited with the amount of the invoice and debited with the goods purchasedservices received by the company. In the cash conversion cycle companies match the payment dates with accounts receivables ensuring that receipts are made before making the payments to the suppliers. This process only applies to purchases made on account.

When a cash payment is made on an account payable. The key accounts payable accounting tasks are noted below. This involves setting out the items or services to be purchased as well as the price.

In the double-entry bookkeeping system the amount of accounts payable is increased on the credit side and a debit is registered in another account. The term accounts payable refers to the individual balance sheet account that tracks the short-term debts for business goods and services bought on credit as well as to the business department responsible for repaying these short-term debts. Are recorded by a company when it purchases goods and services on credit and will make payment in a future period.

The Accounts Payable Process is the management and execution of the companys short-term payment obligations to the vendorsupplier.

Accounts Payable Explanation Accountingcoach

Accounts Payable Explanation Journal Entries Examples Accounting For Management

Belum ada Komentar untuk "When a Payment Is Made on an Account Payable"

Posting Komentar